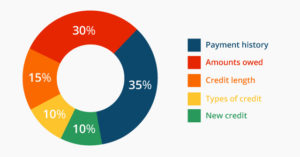

Credit utilization rate measures how much of your available credit you’re using at any given time. It calculates the sum of your credit card balances divided by your total credit limit. Using 100% of your available credit means you’ve maxed it out. Credit utilization is a significant factor in many credit scoring models. If you’re using over a certain percentage, lenders may think you’re attempting to overspend, and that can impact your scores.

Just how much credit can you use without seeing a drop in your scores?

Conventional wisdom suggests avoiding a credit utilization rate of above 30%, and generally, lower balances are better. Paying off your cards every month is ideal. Credit utilization only includes your revolving credit accounts, such as credit cards. It doesn’t consider other types of credit like auto loans or mortgages.

It’s also worth noting that credit scoring models consider both your overall utilization (across all of your cards) and the individual utilization on each card. So having just one card maxed out could do damage to your scores, even though your overall utilization is low.

Late and Missed Payments

Late payments can carry a hefty penalty. Many credit card companies charge fees for late payments. Additionally, late payments will be on your credit report for seven years. Payment history is a significant factor in many credit scoring models, so it’s an important area to keep an eye on for many reasons. Especially when you’re new to credit and starting your credit history, just a few late payments can stick with you for a while.